Lifetime Allowance

![]() 6 minute read

6 minute read

![]() Last updated 9 December 2020

Last updated 9 December 2020

This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

Overview

The Lifetime Allowance came into force in 2006 as part of the A-Day tax regime. The changes introduced at that time came about as a result of the desire to simplify the previous pensions regime that had nine different regime structures, some limiting the amount of money (and relief) that could be put into a pension, others limiting the amount that could be taken out at retirement and some applying a combination of both.The Lifetime Allowance (LTA) seeks to limit the amount of pension savings over an individual’s lifetime that can benefit from tax relief. Pension savings are tested against the LTA at various times, usually when benefits arise under a pension arrangement – known as “Benefit Crystallisation Events”.

In practice there is no limit on the amount of money someone can save into a pension scheme but through the operation of the LTA (and the Annual Allowance) the tax charges that are applied to accruals in excess of the limit are intended to provide an appropriate mechanism to recoup excessive tax relief.

In this article

|

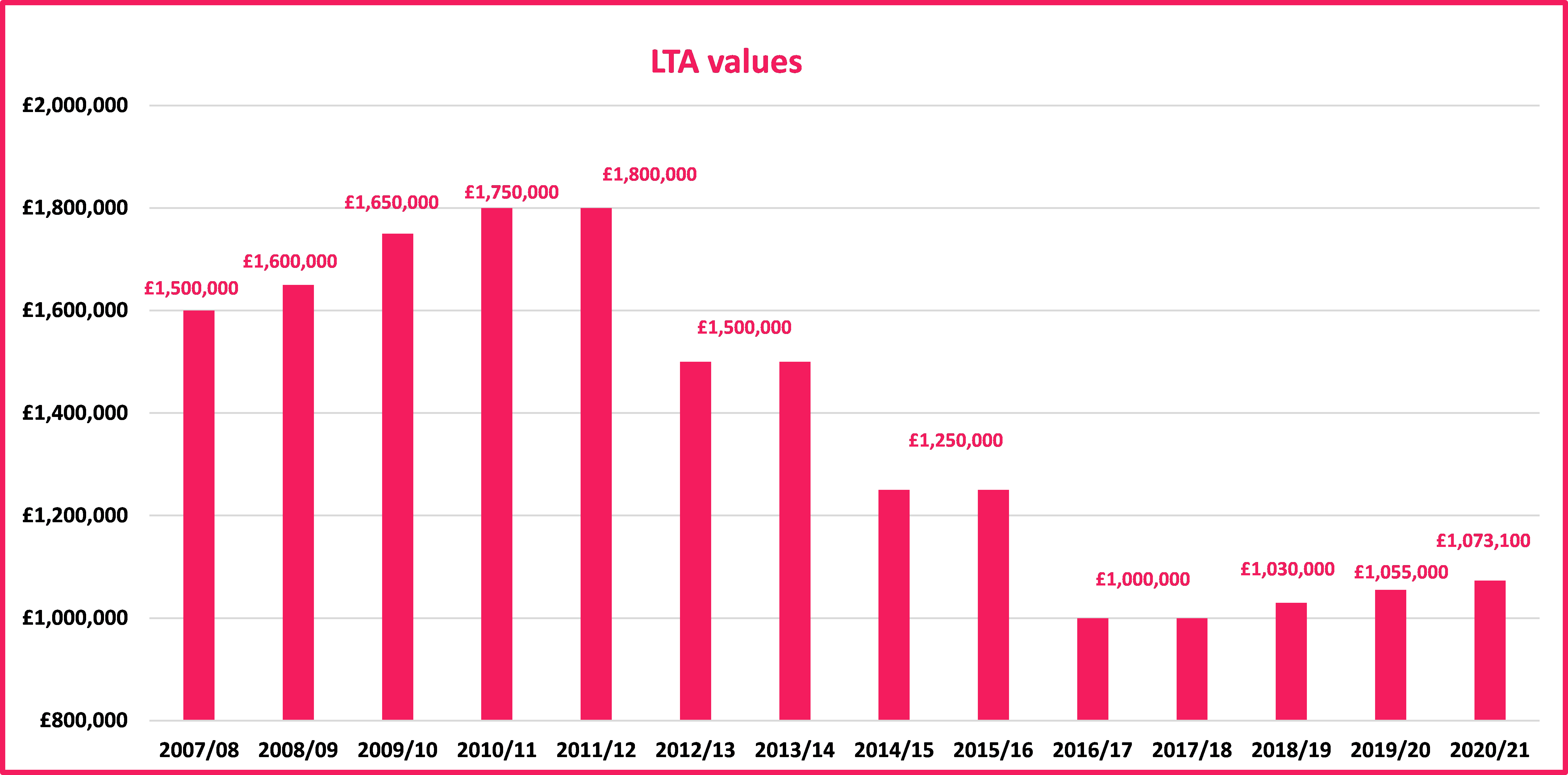

Changes to LTA over time

The original draft simplification rules in 2004, proposed to set the LTA at a limit comparable to the maximum pension a 60-year old could accrue from a defined benefit pension based on the earnings cap applying at that time – the earnings cap being the maximum amount of earnings allowable for calculating pensions accrual. The rules proposed a 20:1 factor to apply against a two-thirds pension of the earnings cap giving rise to an initial LTA of £1.4 million. When the legislation came into force in 2006 the LTA was finally set at £1,500,000 with increments for the following five years up to £1,800,000 with a quinquennial review going forward.Since the introduction of the new rules in 2006 successive governments have considered different methods to limit the amount of pension’s tax relief and this has resulted in a number of changes to the prevailing level of LTA. The initial change came in 2010/11 when the LTA was frozen at £1.8 million for a period of five years. It was reviewed again in 2012 and reduced to £1.5 million with two further reductions in 2014 and 2016 to £1.25 million and £1 million respectively.

For 2020/21 the Lifetime Allowance was increased in line with price inflation to £1,073,100.

The existing range of protections are listed below

- Primary and Enhanced Protection

- Fixed Protection 2012, 2014 or 2016

- Individual Protection 2014 or 2016

- Enhanced Lifetime Allowance

Benefit crystallisation events (BCE)

The legislation specifies the occasions when a scheme administrator must check whether the pension benefits arising (crystallising) at that point exceed the member’s available LTA. These occasions are known as Benefit Crystallisation Events (BCEs).When a BCE occurs, the scheme administrator compares the value of the member’s pension benefits to the member’s LTA that is still available. Any crystallising amount that exceeds the level of LTA available is charged to tax under the LTA charge.

BCEs occur primarily when a member takes benefits from the scheme but there are other occasions when a BCE test can arise such as transferring to an overseas pension scheme or on unused funds at age 75. An individual can have several BCEs over their lifetime. The value of benefit crystallised at each BCE is deducted from the individuals LTA with the remaining balance carried forward (see below).

The LTA charge

The LTA charge applies when, at a BCE, the value crystallising in an individual’s pension scheme is worth more than their available LTA.- If the excess is a pension income, there’s a 25% charge

- If the excess is a lump sum, there’s a 55% charge

The LTA in practice

So, if there are uncrystallised funds of £200,000, normally £150,000 could be used to provide a drawdown pension or annuity, with £50,000 being paid as a pension commencement lump sum.

If £100,000 of the amount to crystallise exceeds the LTA the member would be given the option of drawing £100,000 as a Lifetime Allowance Excess Lump Sum, after the first £100,000 had been used for drawdown (£75,000 as the drawdown fund and £25,000 as a tax free lump sum).

In a defined benefit scheme there is no capital value associated to the defined pension so the actual amount being crystallised is derived by multiplying the value of the annual pension entitlement by a relevant valuation factor. This relevant valuation factor is 20.

As an example, if there is a pension of £20,000 per annum in a defined benefit occupational pension scheme at the point of retirement it is this amount that is used to compare to the LTA. Using the relevant valuation factor of 20:1, the crystallised value of that pension for lifetime allowance purposes is £400,000. Where the tax free lump sum entitlement is not paid by commutation of the annual pension but is a separate additional amount then this would be added to the result of the pension conversion formula to arrive at the value for the LTA test.

Operation of the LTA over time

When a member decides to take benefits from their pension arrangement the percentage of the LTA being used up is added to any percentage used by any earlier BCEs that have taken place under the same or any other registered pension scheme.

The percentage of the LTA used up at any given point remains constant year by year even though the standard LTA may have changed over time. For example, if a BCE used up 20% of the standard LTA when its level was £1.0 million then that percentage will remain constant at 20% in the later years as the allowance changes.

As an example, David has £200,000 of uncrystallised funds in a money purchase plan having previously taken benefits from another scheme where 20% of the LTA was used up. He decides that he wants to take a tax-free lump sum of £25,000 and put £75,000 into drawdown.

At this BCE David has 80% of his LTA remaining. When he crystallises the £100,000 from his pension pot he will use up a further 9.31% based on the current LTA of £1,073,100. Going forward his remaining LTA will be 70.69% so when he takes the balance of his pension it is this amount the benefits will be tested against.

Important Information

The information provided is based on our current understanding of the UK legislation and may be subject to amendments as a result of changes in legislation.All references to taxation are based on our understanding of current UK taxation law and may be affected by future changes in legislation, the individual circumstances of the investor and pension scheme conditions.

The information provided in this article is not intended to offer advice.

Where to next?

-

Back to technical centre

Browse through articles covering topics ranging from tax, financial planning, regulation and more.

-

Literature library

Access our sales aids that explain how our proposition works and show the extra value it provides.

-

Calculators and tools

Access our tools to show your clients how they can live a longer healthier, more financially secure life.