Personal Protection

Serious Illness Cover

Why Serious Illness Cover?

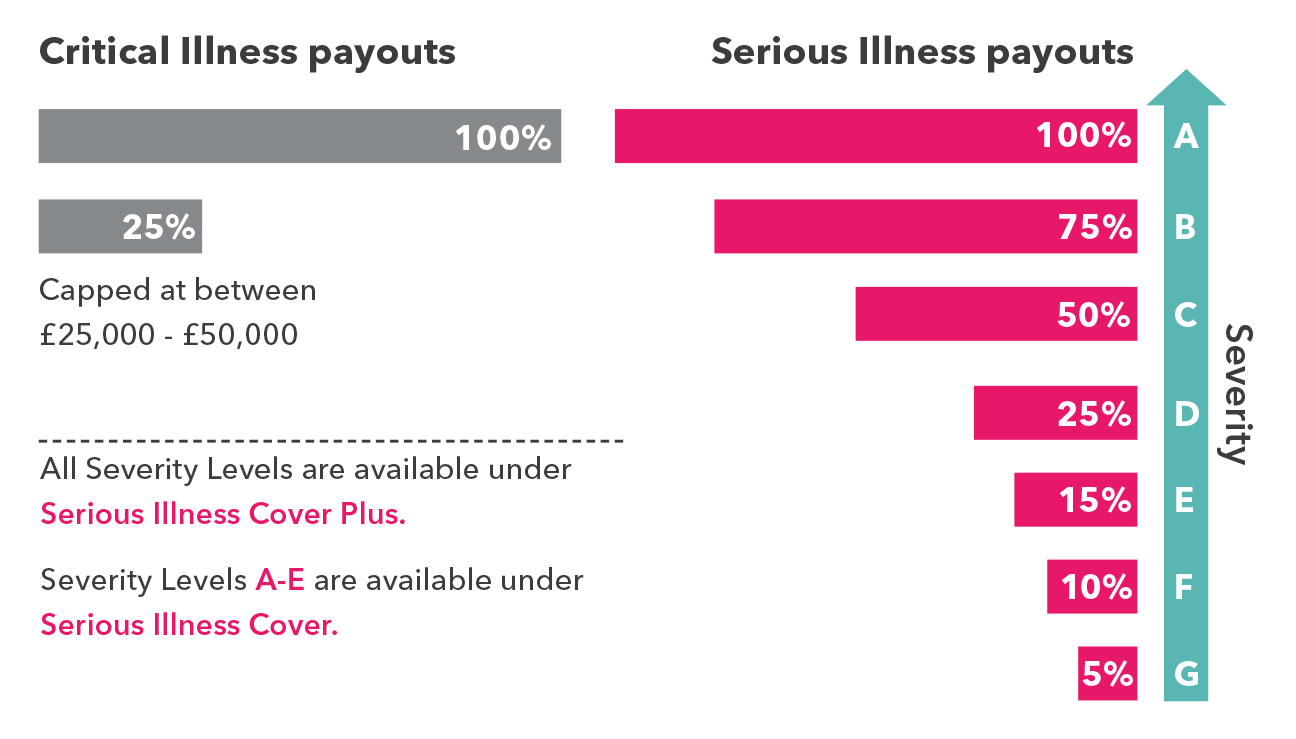

Unlike typical critical illness plans, our award-winning Serious Illness Cover pays out based on the impact that the condition has on your client’s lifestyle, as we recognise early stage illnesses can still cause stress and lead to time off work.If your client needs to claim for a condition that does not use up their full cover amount, they will still have cover available. So if their condition worsens, or they suffer with a different condition, they'll be able to claim again and again, until they've used up the full amount. Providing the reassurance of knowing that, if your client needs to take a health-related break, they’ll be able to continue supporting their lifestyle and family throughout.

Key reasons to recommend Serious Illness Cover.

We take a unique approach to insurance, by being the only provider to integrate wellness and insurance with our Vitality Programme.

-

Your clients are more likely to receive a payout

![one-symbol]()

We cover all heart attacks, all strokes and more cancers than any other insurer2.

-

Claim more than once on the same plan

![two-symbol]()

Serious Illness Cover is more likely to payout than any other critical illness plan in the market3.

-

Cover that can continue into later life

![three-symbol]()

1 in 6 people over the age of 80 have dementia4.

Serious Illness Cover Toolkit.

In this toolkit, you can easily access everything you’ll need to talk to your clients about Serious Illness Cover. We’ve highlighted the most popular resources in yellow, and you can find a list of the others below. You'll find other toolkits throughout our website.

Serious Illness Cover overview

The Power of the Plan Account Sales Aid

Serious Illness Cover Booster Sales Aid

Later Life Options overview

Serious Illness Cover Comparison Tool

Serious Illness Cover Video

E-template

Child Serious Illness Cover.

Are your clients looking to protect their mortgage?

Providing your clients with the support to pay off some – or all – of their mortgage earlier, if they were to suffer a serious illness.

Casper's Serious Illness Cover Claim.

Emma and Nick’s world was turned upside down when their five-month-old son Casper was diagnosed with a rare form of cancer - luckily they had VitalityLife insurance with Child Serious Illness Cover.

Find out more about our Later Life Options.

Choose from two levels of cover - Dementia and FrailCare Cover and Dementia and FrailCare Cover Plus.

Care Made Easy With Supercarers

Finding information about care support can be overwhelming and the costs associated unobtainable. That’s why we’ve teamed up with SuperCarers, to give your clients and their family access to care advice and discounted care services.

Share our Serious Illness Cover video with your clients

How Serious Illness Cover works.

1 Independently verified by Defaqto, November 2019

2 Defaqto verified competitor comparison, September 2020

3 Independently verified by Defaqto, Nov 2019

4 Alzheimer’s society, 2020.