Annual allowance

![]() 4 minute read

4 minute read

![]() Last updated 9 December 2020

Last updated 9 December 2020

This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

Key points

- The annual allowance is a limit placed on the amount of pension inputs in a single year that can benefit from tax relief

- The limit is tested against a pension input period running from 6th April to 5th April each year

- The current standard annual allowance is £40,000

- Where the allowance is exceeded an annual allowance tax charge will apply

Annual Allowance

Introduced in April 2006 as part of the new pensions simplification tax regime, the annual allowance is the maximum amount of tax relievable pension savings that can be made by, or on behalf of, an individual each year. Savers are not restricted in the amount of contributions they can make to a pension scheme – it is only the amount that can receive tax relief that is capped.

Despite this, the annual allowance does not actually limit the actual amount of relief granted when a contribution is made but instead works by applying a tax charge when the annual allowance is exceeded. The charge - the annual allowance charge – recoups the amount of relief given to the part of any annual savings that is excess of the annual allowance.

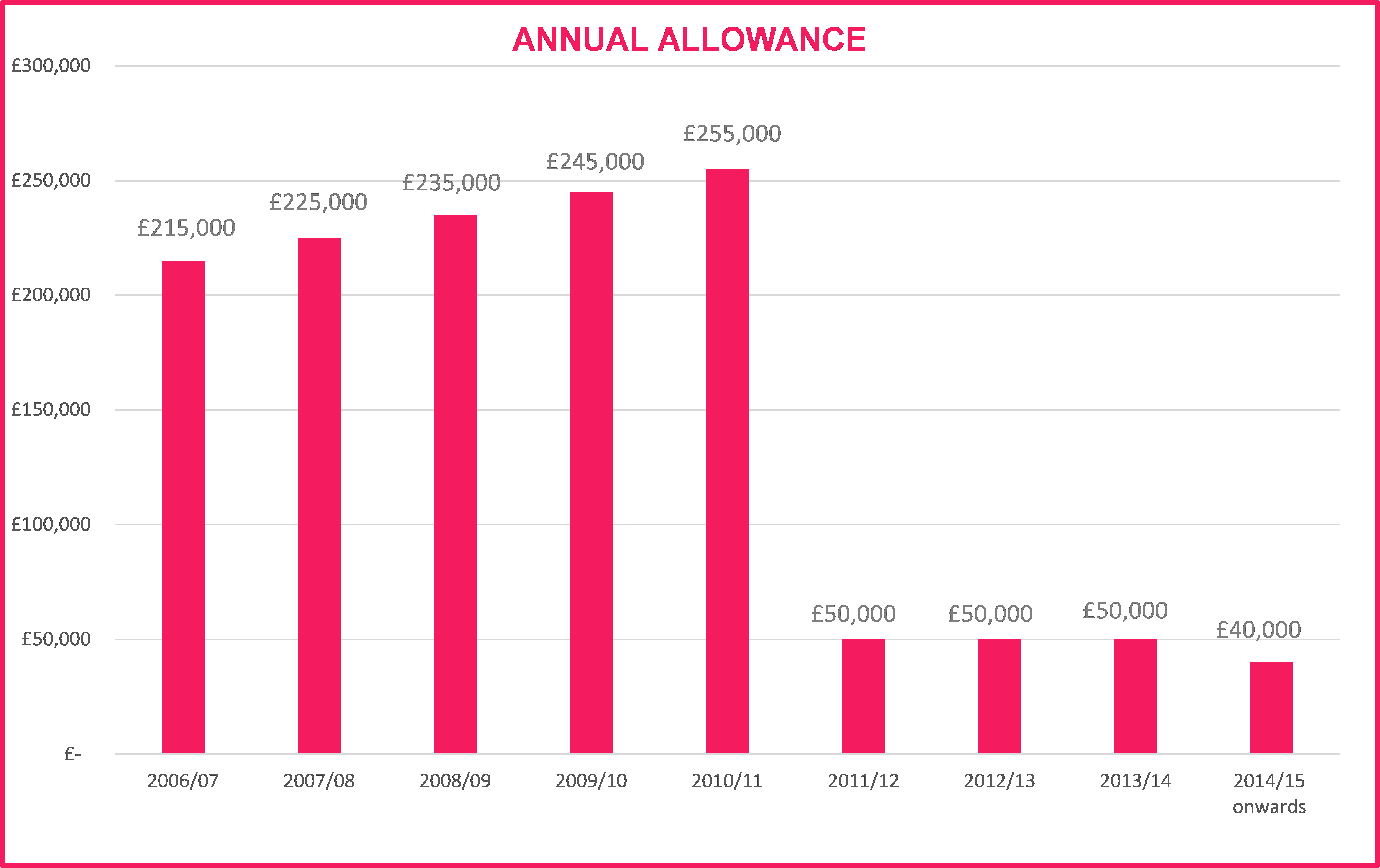

Annual allowance levels

From April 2015 the amount of available annual allowance will depend on the individuals circumstances. The standard annual allowance is currently £40,000 but only so long as the individual has not flexibly accessed a money purchase arrangement, they become subject to the money purchase annual allowance or their annual income is not in excess of £240,000 when they would become subject to a Tapered Annual Allowance.

Testing the annual allowance

Pension savings are known as pension input amounts with the level of savings measured over a tax year called a pension input period. From April 2016 pension input periods run from 6 April to 5 April each year and the overall level of contribution, or input, is tested over this period.

The first step in testing an individual’s pension input amount against the annual allowance is to calculate the increase in value of the pension saving over the input period.

How this value is assessed for each separate arrangement will depend on the type of scheme that is measured.

- For money purchase arrangements the pension input amount for an individual is the total gross contributions paid in the pension input period by the individual, their employer, and any other person on behalf of the individual.

- For defined benefits arrangements the pension input amount is based on how much the value of the individual’s accrued pension and, in certain cases, lump sum has increased over the pension input period. The increase is the difference between the value of the individual’s benefits immediately before the start of the pension input period (the opening value) and the value of the individual’s benefits at the end of the pension input period (the closing value).

- For cash balance arrangements the pension input amount is based on the increase in the individual’s promised pension pot over the pension input period.

For a hybrid arrangement the possible types of benefit and their pension input amounts have to be identified be they money purchase or defined benefit. The pension input amount for a hybrid arrangement is the greatest of the possible pension input amounts.

Pension input periods

All pension input periods have now been aligned to the start and of the tax year. Any open pension input periods that had started before 8 July 2015 (whether or not the first pension input period for the arrangement) ended on 8 July 2015 with subsequent periods running firstly from 9 July 2015 and ending on 5 April 2016, and then the tax year 2016/17 and so on for subsequent tax years.

When the first pension input period for an arrangement starts on or after 9 July 2015 that pension input period will end on the following 5 April.

Annual allowance charge

The annual allowance charge is a tax charge on the individual and arises where the total amount of pension input for a particular year exceeds that annual allowance for that year and any unused allowance from recent previous years.Normally the individual will pay their annual allowance charge liability and account for the payment by completing a self assessment tax return but from August 2011 individuals can in some circumstances elect to require the scheme administrator of their pension scheme to pay some or all of their annual allowance charge liability. This is known as 'Scheme Pays'.

The annual allowance charge is not at a fixed rate but will depend on how much taxable income the individual has and the amount of their pension saving in excess of the annual allowance. The amount can be in whole or in part at 45%, 40% or 20%, depending on the individual’s taxable income and the amount of their pension savings that are in excess of the annual allowance.

Important Information

The information provided is based on our current understanding of the UK legislation and may be subject to amendments as a result of changes in legislation.All references to taxation are based on our understanding of current UK taxation law and may be affected by future changes in legislation, the individual circumstances of the investor and pension scheme conditions.

The information provided in this article is not intended to offer advice.

Where to next?

-

Back to technical centre

Browse through articles covering topics ranging from tax, financial planning, regulation and more.

-

Literature library

Access our sales aids that explain how our proposition works and show the extra value it provides.

-

Calculators and tools

Access our tools to show your clients how they can live a longer healthier, more financially secure life.