This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

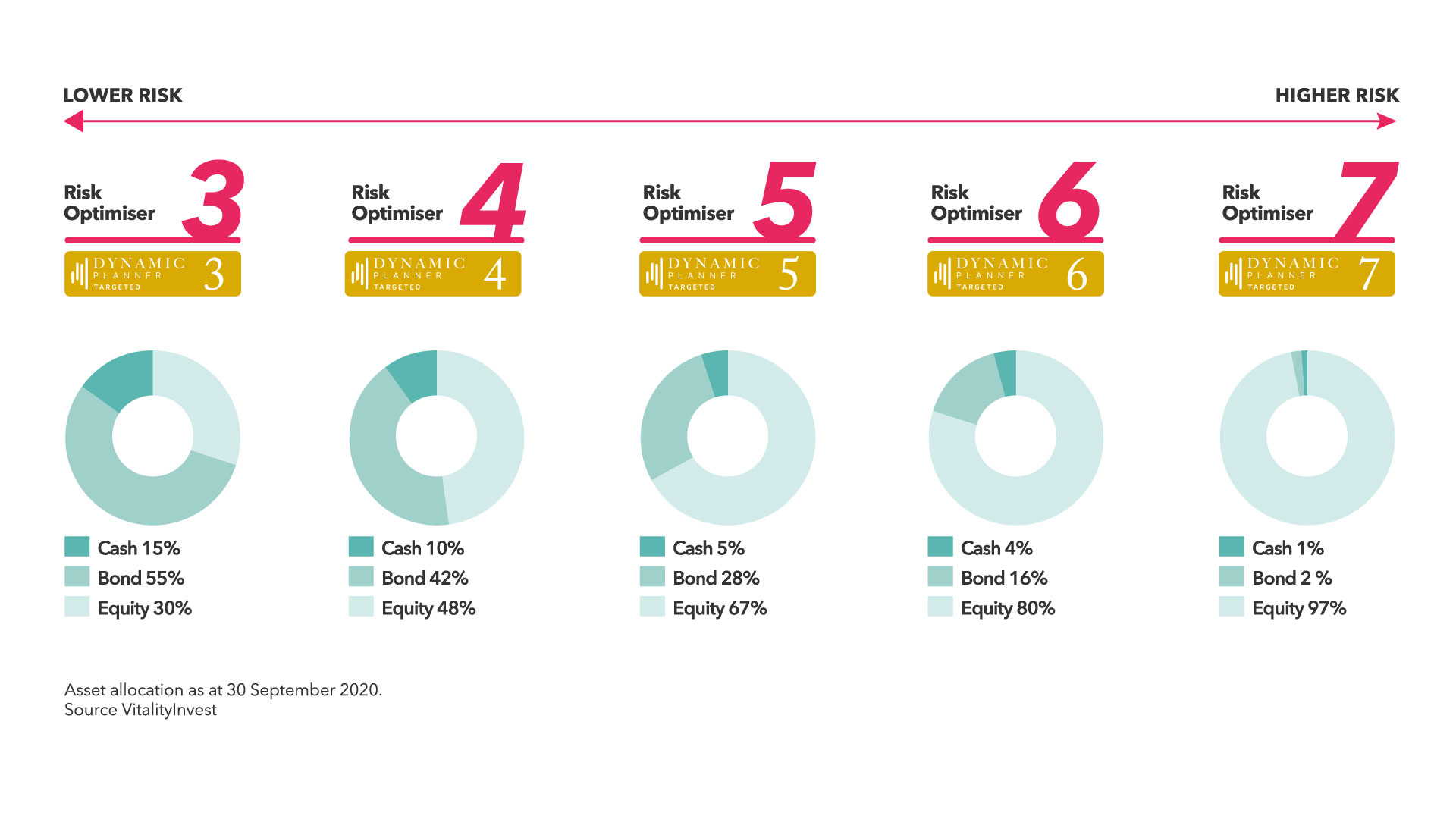

A range of five competitively priced, multi-asset risk-targeted funds, each carefully managed to optimise long-term returns, while remaining within their respective target risk profile

The funds are constructed using asset allocation inputs provided by Dynamic Planner, corresponding to each fund's risk level. Exposure is achieved by investing in a range of Vanguard index-tracking funds in order to keep costs low and maintain high levels of liquidity.

Key features

-

Ready-made solution at a competitive cost

![Coins icon]()

Designed to fit your advice process – the funds offer access across client risk-profiles, asset classes and geographies. Through our plans with Healthy Fee Saver your clients can invest at a fund charge of 0.25% p.a.

-

Gold standard risk targeting

![Medal icon]()

Asset allocation is in line with your client's risk profile and reviewed continuously through daily monitoring and dynamic re-balancing to meet Dynamic Planner’s Gold Standard target risk profiles.

-

Established governance framework

![Presentation file icon]()

Peace of mind to you and your clients by governing our fund range with clearly defined policies and robust standards. With our rigorous approach, we help take the burden of complex asset allocation review and due diligence away from you, freeing up your time to focus on your clients’ needs.

The funds

Why we partner with Dynamic Planner

We have chosen Dynamic Planner as our asset allocation provider due to their strong experience and convincing track-record. As well as being a leading provider of asset allocation advice, Dynamic Planner provides an award-winning digital risk profiling and financial planning service.

Dynamic Planner risk profiles more than 1,400 investments for more than 110 asset managers each quarter and have £220 billion of funds managed against Dynamic Planner risk profile targets.

Dynamic Planner is used by thousands of financial planners from more than 1,900 firms to ensure investment suitability in their recommendations for clients.1

Why we partner with Vanguard

Vanguard Group has £4.8 trillion AUM, three quarters of which is in index-tracking funds. Vanguard launched in the UK in 2009, and have gathered over £162 billion assets in Europe (£120 billion of which is UK AUM). They have a global presence with 30 million investors in 170 countries.

Vanguard was founded in 1975 and pioneered index investing, including introducing the first index-tracking fund for individuals in the USA. Vanguard currently support over 7,000 UK financial advisers selling their funds2.

Where to next?

-

VIRO Funds

A range of five multi-asset risk-targeted funds, each carefully managed to optimise long-term returns, while remaining within their respective target risk profile.

-

Blended Funds

Five multi-asset funds that bring together actively managed and index-tracking strategies.

-

Global Multi-Manager Funds

Five multi-manager funds offered in partnership with SEI Investments (SEI), one of the world's largest manager-of-managers.

-

Funds

Explore the range of Vitality funds and third-party funds designed to cater for a wide variety of client needs.

or call 0800 096 4368

Lines are open (freephone)

Monday to Thursday: 8am - 9pm

Friday: 8am - 7pm

Saturday: 9am - 5pm

Sunday: closed

“Vanguard” is a trade mark of The Vanguard Group, Inc., and has been licensed for use by Vitality Life Limited.

1 Dynamic Planner. September 20202 Vanguard, 31 July 2020.