Introducing the EnVIRO fund range.

This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

Explore our new range of five ready-made ESG focused funds.

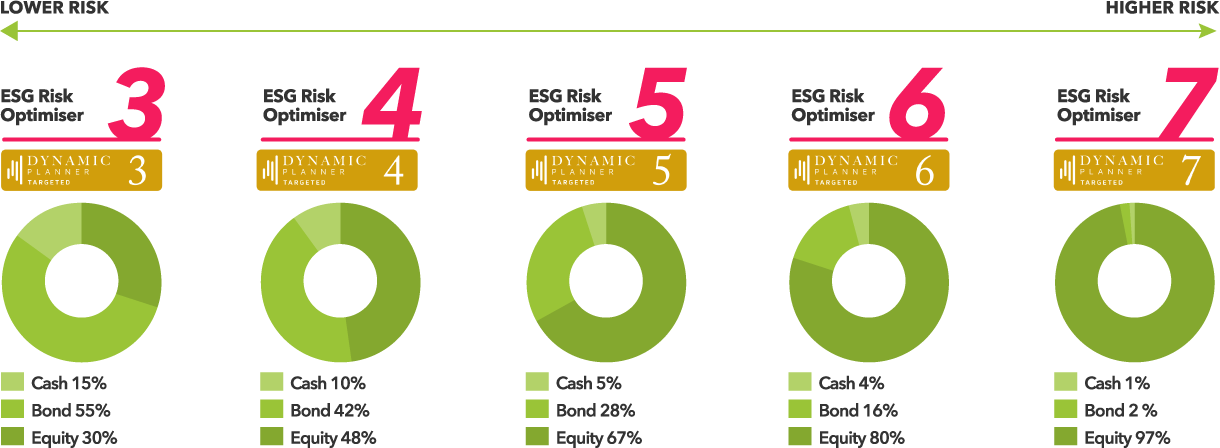

The EnVIRO fund range is our range of Environmental, Social and Governance (ESG) focused funds that enables you to seamlessly integrate ESG into your existing advice process, while offering your clients a simple way to invest in a more sustainable future.Each of the funds within the EnVIRO range is built using underlying index-tracking funds and is designed to optimise long-term returns while focusing on sustainable outcomes. With Dynamic Planner Gold Standard risk ratings, the funds can cater for a wide variety of risk profiles. This gives you certainty that the asset allocation is in line with your clients’ preferences, coupled with the ease and convenience that ready-made solutions offer. The funds also feature ongoing governance at their core, helping to take care of time consuming due diligence for you. It’s the same rigorous framework that’s successfully governed our VIRO fund range for over three years.

Three reasons to choose the EnVIRO fund range.

-

Investments for a sustainable future.

![Icon one]()

We offer your clients a cost-effective way to achieve sustainable outcomes. We aim to exclude companies that do harm and, where possible, select those with above-average sustainable outcomes. We also review the holdings and approach on an on-going basis.

-

We meet Gold standard risk-targeting.

![Icon two]()

We integrate ESG easily into your existing advice process, with ready-made solutions to fit your clients’ risk profiles. Asset allocation is reviewed through daily monitoring and dynamic rebalancing, to meet Dynamic Planner's Gold Standard risk-targeting.

-

Established governance framework.

![Icon three]()

We’ve applied the same rigorous approach that’s governed the Vitality fund range for over three years. This helps reduce the burden of having to carry out complex asset allocation reviews, assessment of ESG criteria and due diligence, giving you time to focus on client needs.

EnVIRO fund range Toolkit.

In this toolkit, you can easily access everything you’ll need to talk to your clients about our EnVIRO fund range. We’ve highlighted the most popular resources in yellow, and you can find a list of the others below. You'll find other toolkits throughout our website.

Customer brochure - EnVIRO fund range

Special introductory offer.

All clients qualify for a 50% refund. This can rise to a 100% refund, depending on their Vitality status at the end of the 12-month offer period, as follows:

|

Vitality status |

% of ESG fund charge refund |

| Bronze |

50% |

| Silver |

60% |

| Gold |

75% |

| Platinum |

100% |

Working towards a more sustainable future.

Our unique approach to investments - based on incentivising positive behaviour - can deliver economic and health benefits that are good for your clients, good for you, good for us and good for both society and the environment. We call this Shared Value.

Through our Shared Value Model, we can offer a unique approach to investing that brings together wellness and financial planning. So not only can we help your clients enjoy healthier and more financially secure lives, we can now help them to invest in a more sustainable future.

Investing sustainably across our other investment solutions.

We ensure ESG principles are a key part of our investment partners’ philosophy.

-

Our investment partner Vanguard believes sustainable investing starts with the premise that index funds can hold a company’s stock in perpetuity. With such a long-term horizon, Vanguard focuses on how companies are set up for success in a more sustainable world.

-

Our investment partner SEI Investments (SEI) integrates ESG factors into the manager research process, through their proprietary ESG ranking system. This forms the basis of SEI's decision to hire managers that align to their ESG principles.

-

Our investment partner Ninety One aims to help investors make a positive difference to people and the planet while delivering long-term investment returns. They do this through a robust and comprehensive integration of sustainability considerations into their strategies.

The funds

| Name | Aim | Ongoing charges | Fund fact sheet | SID |

|

VitalityInvest ESG Risk Optimiser 3 |

ESG focused, risk optimised, multi-asset funds investing in index-tracking strategies. Gold standard risk ratings by Dynamic Planner. |

F Series: 0.35% |

Download | Download |

| B Series: 0.50% | Download | Download | ||

|

VitalityInvest ESG Risk Optimiser 4 |

F Series: 0.38% |

Download |

Download |

|

| B Series: 0.53% | Download | Download | ||

|

VitalityInvest ESG Risk Optimiser 5 |

F Series: 0.42% |

Download |

Download | |

| B Series: 0.57% |

Download | Download | ||

|

VitalityInvest ESG Risk Optimiser 6 |

F Series: 0.46% |

Download |

Download |

|

| B Series: 0.61% | Download | Download | ||

|

VitalityInvest ESG Risk Optimiser 7 |

F Series: 0.50% |

Download |

Download |

|

| B Series: 0.65% | Download | Download |

Where to next?

-

VIRO Funds

A range of five multi-asset risk-targeted funds, each carefully managed to optimise long-term returns, while remaining within their respective target risk profile.

-

Blended Funds

Five multi-asset funds that bring together actively managed and index-tracking strategies.

-

Global Multi-Manager Funds

Five multi-manager funds offered in partnership with SEI Investments (SEI), one of the world's largest manager-of-managers.

-

Funds

Explore the range of Vitality funds and third-party funds designed to cater for a wide variety of client needs.

or call 0800 096 4368

Lines are open (freephone)

Monday to Thursday: 8am - 9pm

Friday: 8am - 7pm

Saturday: 9am - 5pm

Sunday: closed