Why talk about market downturn now? Why not?

Published: 07/04/2021

In this article, Vanguard provide a timely reminder about what it means to be a long-term investor and why it’s important for your client to invest strategically, so they’re best prepared, whatever the circumstances.

Some may say it’s always the right time to talk about long-term investing. Now might be a particularly good time, however, with global stock markets near all-time highs and uncertainty all around. Better to pulse-check now than when markets are trending lower and emotions are running high.

The economy and markets are sending mixed signals

Most major economies remain in the throes of the Covid-19 pandemic and many expect fiscal and monetary policy to remain supportive in the months ahead. But in a still-distant future, the unwinding of support as Covid-19 is addressed and economic activity correspondingly picks up will have implications for economic fundamentals and financial markets.Central banks have signalled their intentions to keep interest rates low well beyond 2021 but markets, forward-looking as they are, will eventually price in rate hikes. This means the low rates that have helped support higher equity valuations will eventually start to rise again. Somewhat higher inflation at some point is also a risk that we’ve been discussing.

As we also noted in our annual outlook, stock market indexes in many developed markets appeared to be valued fairly but toward the upper end of our estimates of fair value. To that end, the Standard & Poor’s 500 Index of leading US stocks finished 2020 at a record high and has done so a further eight times already in 2021.

Volatility that has accompanied recent high-profile speculation in a handful of stocks and even commodities only adds to the uncertainty, as Vanguard’s chief investment officer, Greg Davis, recently addressed here.

So let’s talk about the value of long-term investing

It goes without saying that the goal is to prepare an investor for long-term success. And that means helping you to guide your clients so they can focus on the things they can control: having clear, appropriate investment goals; maintaining portfolios well-diversified across asset classes and regions; keeping investment costs low; and taking a long-term view.It’s recommended to pay particular attention to the last of them – by reminding clients to keep their discipline.

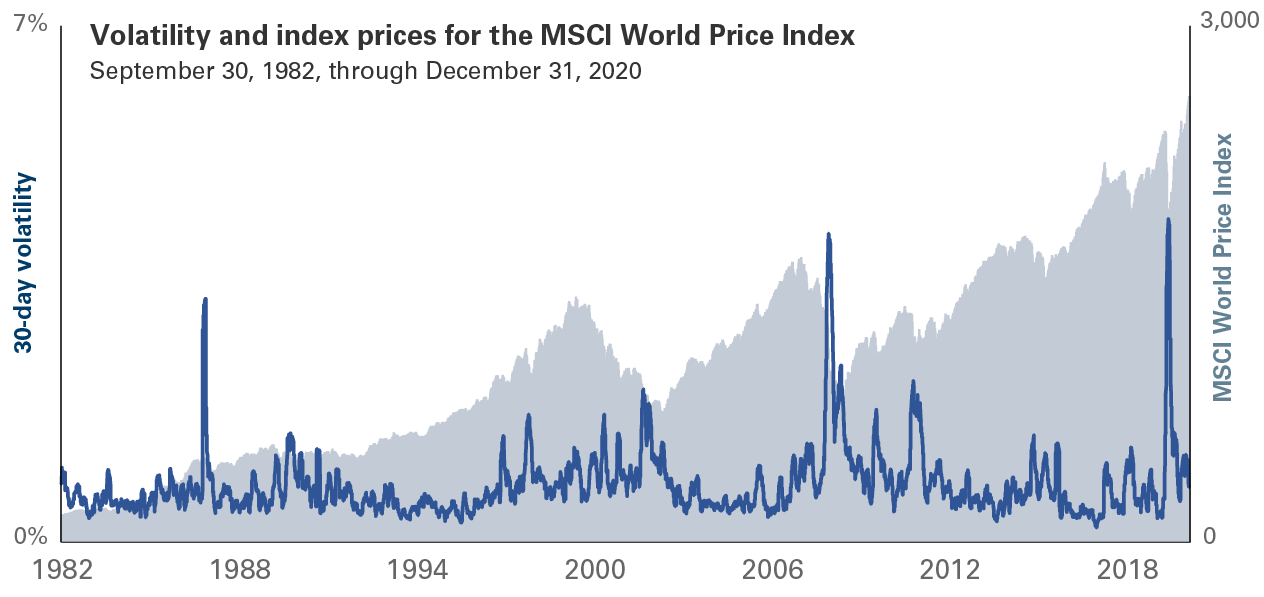

As the illustration below shows, market volatility is a fact of life for investors, and so are market downturns.

Past performance is not a reliable indicator of future returns. Note: Volatility is calculated as the standard deviation of price return from trailing 30 business days for the MSCI World Index.

Sources: Vanguard calculations, based on data from Thomson Reuters Datastream.

It is good guidance for your clients, regardless of whether a downturn may be on the horizon or not.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.Past performance is not a reliable indicator of future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

© 2021 Vanguard Asset Management, Limited. All rights reserved.

© 2021 Vanguard Group (Ireland) Limited. All rights reserved.

© 2021 Vanguard Investments Switzerland GmbH. All rights reserved.

VitalityInvest is a trading name of Vitality Corporate Services Limited. Vitality Corporate Services Limited is authorised and regulated by the Financial Conduct Authority. 08/04/2021 | This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes.

Where to next?

-

Five things financial advisers should know following the 2021 Budget

Market experts across pensions, protection and workplace wellbeing explore the key takeaways.

-

Market & Fund Performance Commentary

SEI's investment management team summarises market conditions and outlook over the year so far.

-

Insights Hub

Our Insights Hub brings you our range of adviser content - from video series to articles & blogs.