Positioning clients’ portfolios for a recovery.

Published: 7th April 2020

This site is for UK investment professionals only. If you're

not an investment professional, please find out more about us at vitality.co.uk.

With most client portfolios down – in some cases significantly – over the past 6 weeks, advisers are encouraging them to stay the course and avoid crystallising losses. Advisers are also weighing up which investment solutions are best placed to lead their clients into recovery and beyond. In these circumstances, evaluating the impact of costs is critical.

Equity markets across the world were ravaged over late February and March as society, business and governments tried to formulate a response to the Covid-19 pandemic and adjust to new ways of working and living. By 23 March the S&P 500 index had experienced its fastest fall in history: it had taken just 22 trading days to lose 30% of its value from the high on 19 February. A period of muted recovery followed, as governments and central banks introduced emergency measures to stabilise the situation. The situation continues to evolve daily. While it is premature to call an end to the market turmoil, it may be time to take stock of where we are and think about the future.Where are we now?

Losses have been made. Unless your entire wealth was in cash, even the most cautious saver is now worse off than they were 6 weeks ago. But now that we are here, from our discussions with advisers it seems that most are going out with the message that in most cases clients should ride it out, stick to your plans, don’t panic, don’t crystallise losses. This is sound advice. History has shown that after major crises markets do recover in time, even if we don’t know quite how long this will take.Positioning for the future

Crises like these always prompt us to look at the way we have done things in the past, and question whether they are still appropriate. When we assess our current position, a critical success factor for advisers will be how they position their clients to recover the value their savings have lost. Much of this will depend on the investment solutions they choose.Here, we recognise that advisers have different beliefs or preferences when it comes to investing their clients’ money. Some have a steadfast belief in active management – confident they can identify good managers (or reliably entrust others to do so). Others believe that paying more for the uncertain expectation of out-performance makes no sense at all, and investors are best served by investing in sensibly constructed low-cost portfolios. These beliefs have formed over time, and are tightly held. We are not suggesting they should change.

But within an adviser’s chosen approach, the provider they choose could make a massive difference to their clients’ outcomes.

The impact of charges

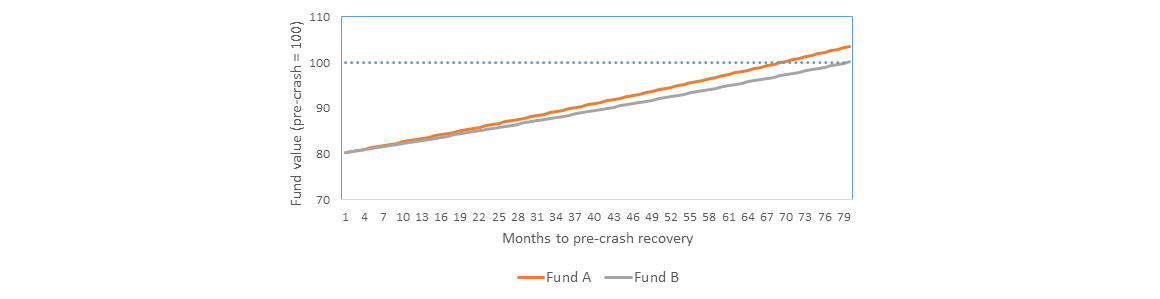

Let’s consider the following scenario:- A client’s assets have fallen 20% from their peak on 19 February 2020

- Providers A and B both offer an outsourced, actively managed fund solution appropriate to the client’s risk profile

- The total cost (OCF plus platform charge) of accessing Provider A is 1.0% p.a.

- The total cost (OCF plus platform charge) of accessing Provider B is 1.5% p.a.

- Assumed recovery growth rate for both funds is 5% p.a. (gross of charges)

How VitalityInvest can help

We have constructed our investment plans to enable advisers and their clients to access a wide variety of fund options at highly competitive charges. What’s more, while our product charges at entry start low, clients have the opportunity to reduce these even further – to as little as zero – when they engage in positive lifestyle habits which we have made more accessible through the introduction of Vitality at Home. With our solutions constructed with value to clients in mind, the charge differential above is eminently achievable relative to many of our competitors’ offerings.Other considerations

Clearly, charges are not the only criteria to consider.Advisers who prefer a low-cost approach should ensure that their chosen provider is able to offer diversification across asset classes and daily liquidity under all market conditions, and is backed by a robust governance process. These factors are central to our VitalityInvest Risk Optimiser Range.

Advisers looking for an active outsourced fund solution will want to ensure the chosen funds are backed by an experienced, well-resourced team with the ability to research and access some of the best fund managers from across the world. And they will look carefully at the fund manager’s ability to assess and control portfolio risk on a real-time basis. These are the criteria that define our VitalityInvest Global Multi-Manager fund range, managed by SEI, one of the world’s leading manager-of-managers.

Advisers are looking to steer their clients back to the prosperity they enjoyed before the recent market falls. We believe we are ideally placed to get them there.

Important Information

Nothing herein should be construed as an offer to enter into any contract, investment advice, a recommendation of any kind, a solicitation of clients, or an offer to invest in any particular fund or plan. The value of investments and the income from them can go down as well as up and your client may get back less than they invest. This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes.

VitalityInvest is a trading name of Vitality Corporate Services Limited. Vitality Corporate Services Limited is authorised and regulated by the Financial Conduct Authority. 02/04/2020 | This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes.

1 VitalityInvest calculations, ignoring the impact of inflation.