Given the choice, most customers would choose private care. Equally, most would rather not be ill in the first place.

Only Vitality provides a truly integrated solution that combines the highest quality care with a proven programme to help members improve their health and well being.

Vitality’s unique and comprehensive health insurance presents advisers like you with a profitable new business opportunity from your existing Life insurance client bank.

Private Health Insurance

Our Private Health Insurance gives clients fast, stress-free access to high-quality medical facilities and the very latest treatments and most importantly, at a time and place that suits them.

Products such as life insurance, serious illness cover and income protection can help cover the longer-term financial impact of a health event. But only Private Health Insurance addresses the immediate need for consultation, diagnosis, treatment and recovery quickly and cost-effectively.

Vitality Programme

Our plans offer much more than ordinary health insurance and appeal to a wider audience than traditional Private Health Insurance.

We reward members for their healthy habits with discounts and benefits from big-brand partners like Apple, Amazon, Vue, Champneys and more via the Vitality Programme.

As your clients engage with the Vitality Programme and benefit from better health, it enables us to share some of the insurance savings that emerge in the form of better product benefits and incentives – fuelling a virtuous cycle.

While consumers’ expectations of healthcare provision in the UK are understandably high, when it comes to private healthcare, many underestimate the true costs involved.

Private Health Insurance is designed to be an affordable way of getting fast, on-demand access to all these services and treatments, without having to directly meet the cost of tests, drugs and procedures.

With services such as Vitality GP, Advanced Cancer Cover and mental health support offered as part of our Core Cover, our cover provides excellent value through our comprehensive Private Health Insurance plans.

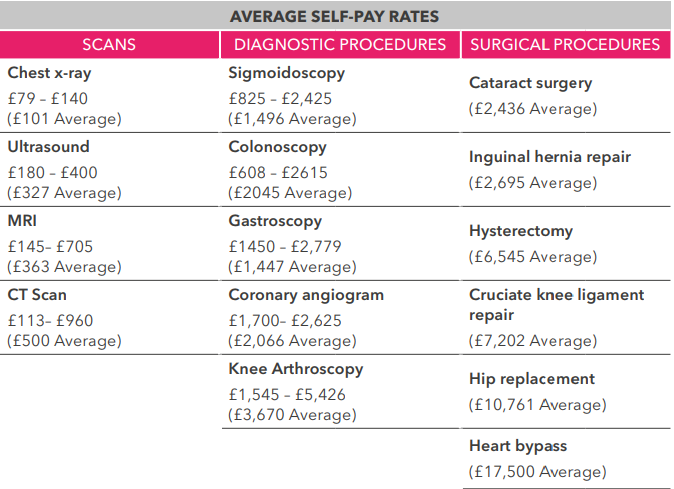

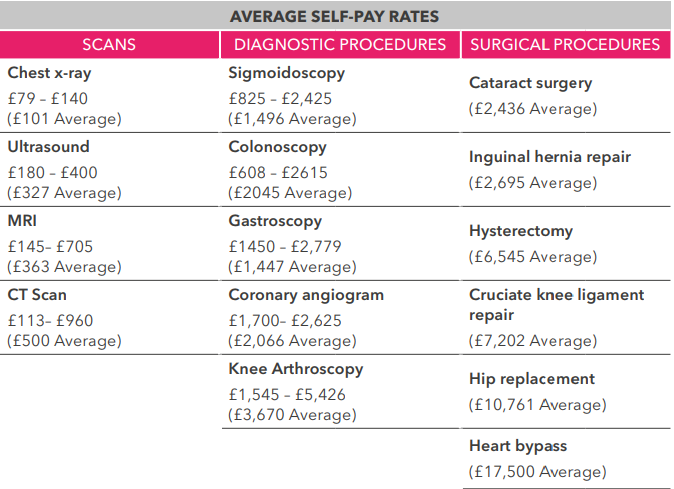

Example: The health costs insured against are significant and one hospital stay can cost more than £10,000

Source: The Private Healthcare UK, 2018.

These tables give indicative costs of common procedures however these will vary between different hospitals and will also vary depending on the clinical nature of each case. They are only intended to give an indication as to the costs involved in private healthcare.

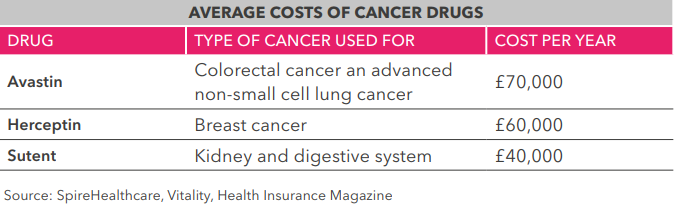

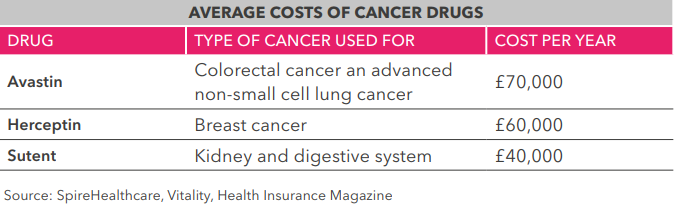

Example: Average costs of some common cancer drugs

Using our Quick Quote tool, you can quickly and easily build a plan that best meets your client’s needs, with clear and transparent costs.

Furthermore, the handy saving calculator shows just how much a member can save using our Vitality partners, helping to offset their insurance premium.

Rewards Programme Savings

Vitality offers more than ordinary health insurance, encouraging healthy behaviour and habits through the Vitality Programme.

As your clients get healthier, they can help lower premiums, get great rewards, and even more incentives to stay well. It’s a virtuous circle that leads to more rewarding cover and a healthier client.

The more members do, the more discounts and rewards they receive meaning members savings can work out to be more than what they pay for their premium.

See how much members can save with our

Savings Calculator Tool

Members can download the free Vitality Member app, which offers an engaging experience by allowing members to:

- Access information on partners and rewards

- Check points and status

- Redeem Active Rewards

Again, another common myth!

Growth in non-Private Health Insurance Specialist Sales

You don’t have to be a Private Health Insurance specialist to get started. We have seen a 37% increase in sales from our non-Private Health Insurance specialist sales channel over the last 3 years.*

*Figure correct as at June 2019

Vitality Tools

With our support, tools and information readily provided and accessible, we equip you with knowledge and ensure you have all the information you need at your fingertips. Your customers trust you for their mortgage, pension and wealth, why not PMI?

We equip you with a large range of resources and tools that will provide support, education and answer any question you may have.

160+ field Business Consultants

Our field-based Business Consultants support you with specialist product knowledge and training.

Vitality Academy

The Vitality Academy, a programme of learning and development, is specifically designed to assure and maintain a foundation level of knowledge. It then supports progress to advanced levels with content designed to help you sell our unique product effectively to your clients, all whilst earning CPD points.

We want to work in partnership, helping you to understand and articulate the value that VitalityHealth offers to your clients.

Online Marketing Toolkit & Literature

We provide you with useful literature and tools to help you when recommending VitalityHealth to your clients. This includes sales aids, benefits at a glance and product guides.

Adviser Hub

Providing you with 24x7 access on all devices, Adviser Hub makes it quicker and easier for you to do business with us, service your clients’ needs and manage their renewals.

Adviser Hub’s features include:

- Simple and easy home page

- Search and view a plan and member

- Add and remove member

- Documentation hub – all plan documents you need

UK-Based Servicing

For both you and your clients.

Not at all.

A company can set up a group scheme with just two employees on cover.

Figures from the Vitality People Study 2018 show just some of the benefits resulting from workplaces engaging with Vitality including:

- 28% fewer sickness episodes than employees who aren’t engaged in the Vitality Programme.

- 45% less absenteeism due to sickness than employees not engaged in the Vitality Programme.

- 38% perform better at their jobs (making more lead generation calls) and are twice as likely to be assessed as high performers.

- 35% greater work engagement. Also, 150% more likely to report high job satisfaction when compared to employees not engaging with the Vitality Programme.

Learn more about Vitality's Business Health Cover