Two years on a proven fund strategy

This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

As we continue to build strong credentials in the investment market, the two-year anniversary of our low cost multi-asset VitalityInvest Risk Optimiser (VIRO) fund range represents an important milestone.

Our VIRO funds are a range of five risk-targeted funds, each carefully managed to optimise long-term returns and designed to stay within Dynamic Planner’s Gold Standard risk guidelines. Since launch, they’ve generated strong returns, while keeping within the set risk parameters.

Rigorous governance supporting the range

One of the key contributors to the range’s success is the rigorous ongoing governance framework we’ve put in place. By establishing a well-defined framework, control processes and committee structure we ensure the fund range is managed in accordance with best practice governance principles.

On a daily basis, we monitor the VIRO funds and rebalance them when required to ensure they stay strictly in line with their strategic asset allocation (SAA). Each fund’s SAA is designed with input from Dynamic Planner to maintain its target investment risk level.

On a monthly basis, our Fund Pricing and Product Forum monitors performance and risk metrics to ensure funds remain within their mandates, and validates that it is in line with expectations. Additionally, on a quarterly basis the executive committee responsible for fund governance and oversight reviews performance and risk metrics.

As well as the governance we have in place, each quarter Dynamic Planner independently reviews the asset allocation of our VIRO funds. Their latest review in Q2 2019 indicates that since launch, the fund range has remained in line with the risk profile assigned to each specific fund and continues to meet Dynamic Planner’s Gold Standard requirements for risk targeted funds.

Stable growth during varying market conditions

We've been delighted that the VIRO funds have performed well within their respective Investment Association (IA) sectors since launch, while remaining within their risk profiles. This is welcome news given the varying market conditions since their launch in September 2017.

In 2018 we saw equity markets fall in Q1, followed by a rally over the second and third quarters. Markets then pulled back sharply in Q4 in light of some weak macro-economic indicators. Volatility continued in 2019, both in the UK - with Brexit uncertainty and related Sterling volatility - as well as globally, with fears of a recession and trade tensions between the USA and China. The positive returns delivered by the VIRO funds under these conditions are a result of their multi-asset diversification and portfolio construction, demonstrating the sustainability of the funds’ strategies.

|

Return (%) to 30 Sept 2019 |

|||

| Fund | 2019 YTD | 1 year | Since launch (annualised) |

| UK Equity | 14.4 | 2.7 | 4.4 |

| VIRO 3 | 11.2 | 7.7 | 11.3 |

| IA Mixed Investment 0-35% Shares Sector | 8.2 | 4.9 | 6.5 |

| VIRO 4 | 13.1 | 7.3 | 12.9 |

| IA Mixed Investment 20-60% Shares Sector | 10.1 | 4.1 | 7.2 |

| VIRO 5 | 14.2 | 6.6 | 13.5 |

| IA Mixed Investment 40-85% Shares Sector | 13.3 |

4.3 |

10.5 |

| VIRO 6 | 14.7 | 5.6 | 13.1 |

| IA Mixed Investment 40-85% Shares Sector | 13.3 | 4.3 | 10.5 |

| VIRO 7 | 15.4 | 4.7 | 12.6 |

| IA Flexible Investment Sector | 12.5 | 3.2 | 9.5 |

Past performance and simulated past performance should not be taken as a guide to future performance. Simulated past performance for VIRO funds has been constructed using historical asset allocations provided by Dynamic Planner with the same asset classes and underlying holdings in which the funds are currently invested. VIRO funds inception: 29 Sept 2017. UK Equity refers to a market cap-weighted Index of c.600 shares listed on the London Stock Exchange. Source: Morningstar Direct, Sept 2019

A reliable investment strategy over the long term

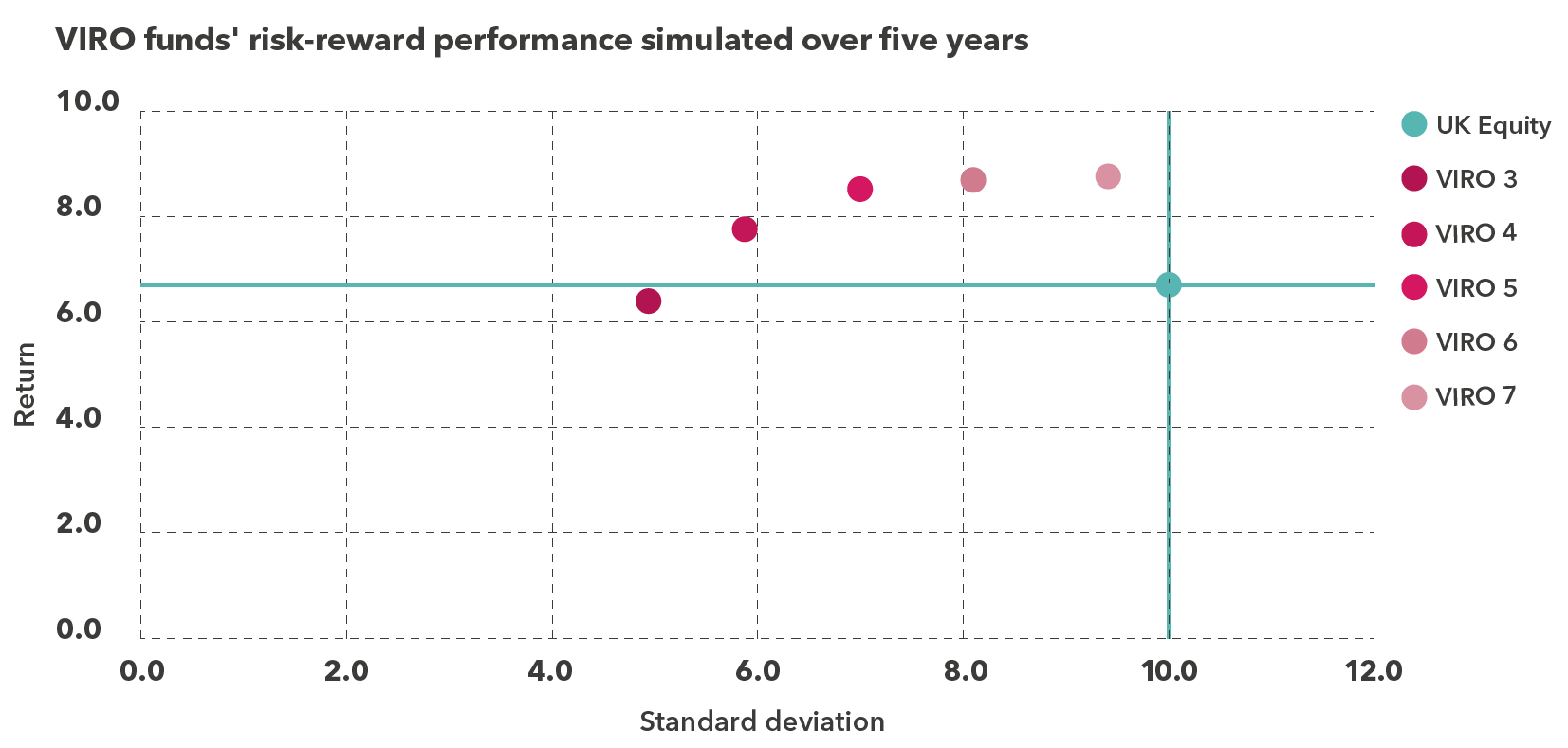

For good measure, applying the systematic way in which the VIRO funds are constructed, we’ve built a simulated longer-term track record of the funds’ performance in order to show the VIRO funds’ risk-adjusted returns over five years. The results show that the range would have delivered better risk-adjusted returns than UK Equity, using the Morningstar UK Index as a reference.

More specifically, the VIRO 4 to 7 funds have outperformed UK Equity, while providing significantly lower volatility than a market cap-weighted Index of c.600 shares listed on the London Stock Exchange. VIRO 3 has delivered positive returns over five years, marginally lower UK equities, at approximately half of the index volatility, while providing diversification across asset classes.

| 5 year return (annulised) (%) | 5 year standard deviation (annualised) (%) | |

| UK Equity | 6.7 | 10.0 |

| VIRO 3 | 6.4 | 5.0 |

| VIRO 4 | 7.7 | 5.9 |

| VIRO 5 | 8.5 | 7.0 |

| VIRO 6 | 8.7 | 8.1 |

| VIRO 7 | 8.8 | 9.4 |

Staying resilient in 2020 and beyond

With the likelihood of continued market volatility on the horizon, your clients are likely to be looking for investment solutions that are resilient. With our VIRO funds now showing a two-year track record of strong returns and staying within their risk parameters, you can have full confidence that our investment approach is aligned with your client's objectives.

To find out moreGet in touch with your Business Consultant or call us on 0800 096 4368.* |

Ways we make it easy to do business with us

- Access to over 400 third-party funds from over 40 leading fund managers and still growing

In the last few months we’ve added over 150 new third-party funds from leading fund managers – and we’ll continue to expand our investment range further. - Intelligent Office and Dynamic Planner daily bulk valuations

Through these back office systems, you can see your clients' investment portfolios in one place, simplifying your client administration. Firms can register to receive daily valuations for plans invested with us. We’re also integrated with Selectapension, O&M, Defaqto and Centra. - Cutting-edge model portfolio functionality

Our state-of-the-art Adviser Hub allows models to be created and updated easily and clients to be moved in and out of models seamlessly. Plus, you can automatically rebalance your models - monthly, quarterly, six-monthly or annually, or on ad-hoc basis for some or all clients. - Special offer: 100% refund of first year product charges

Available until 24 January 2020. We help your clients get the most out of their initial investment with us, by refunding 100% of their first year’s product charge after the first 12 months. We’ve also reduced the base level charge for all clients. And for clients with larger investment pots, we apply a zero product charge on the amount above £250,000 – meaning the maximum annual product charge will be no more than £692.50.

*Lines open Monday to Friday, 9am - 5pm.

Internal figures correct at October 2019.

VitalityInvest is a trading name of Vitality Corporate Services Limited. Vitality Corporate Services Limited is authorised and regulated by the Financial Conduct Authority. 28/10/2019 | This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes. | VI O 0067