Our new Global Multi-Manager fund range, in partnership with SEI Investments

This site is for UK investment professionals only. If you're not an investment professional, please find out more about us at vitality.co.uk.

The investment market has come a long way in recent years: more choice, more ways to manage risk and more focus on client suitability and needs. But all of this takes up more of your time.

So you can focus on what you do best – planning for your clients’ futures – we’ve created a range of actively managed portfolios, built around your advice process, that bring together the right blend of expertise, risk management and value.

Industry-leading, active investing for your clients

The fund range is offered in partnership with SEI Investments (SEI) one of world’s largest manager-of-managers. Made up of five ready-made, risk-profiled investment portfolios, they use SEI's institutional expertise to bring an innovative solution to your clients’ portfolios.

They are diversified across up to six asset classes, 20 sub-asset classes and over 70 investment strategies from some of the world’s leading managers. Each fund aims to achieve long-term growth, while remaining broadly within their respective Dynamic Planner risk-rating. Dynamic Planner independently reviews the asset allocations each quarter, to ensure that the funds continue to meet your clients’ risk preferences.

The fund range offers five key benefits to you and your clients

1. Access to best-in-class investment managers globally including institutional managers and boutique firms not commonly available to retail investors.

2. Up to 70 unique investment strategies each is a customised mandate carefully allocated to a manager with the right skill set, built into an optimised portfolio.

3. A specialist approach to active management by managing diverse, uncorrelated sources of returns across sectors, securities, managers and styles; proven by a track record of long-term outperformance.

4. Real-time risk management combines proprietary and third-party tools with the transparency of investment mandates, enabling portfolio monitoring at all levels.

5. Value through institutional buying power ensuring competitive pricing with a single all-in fund charge.

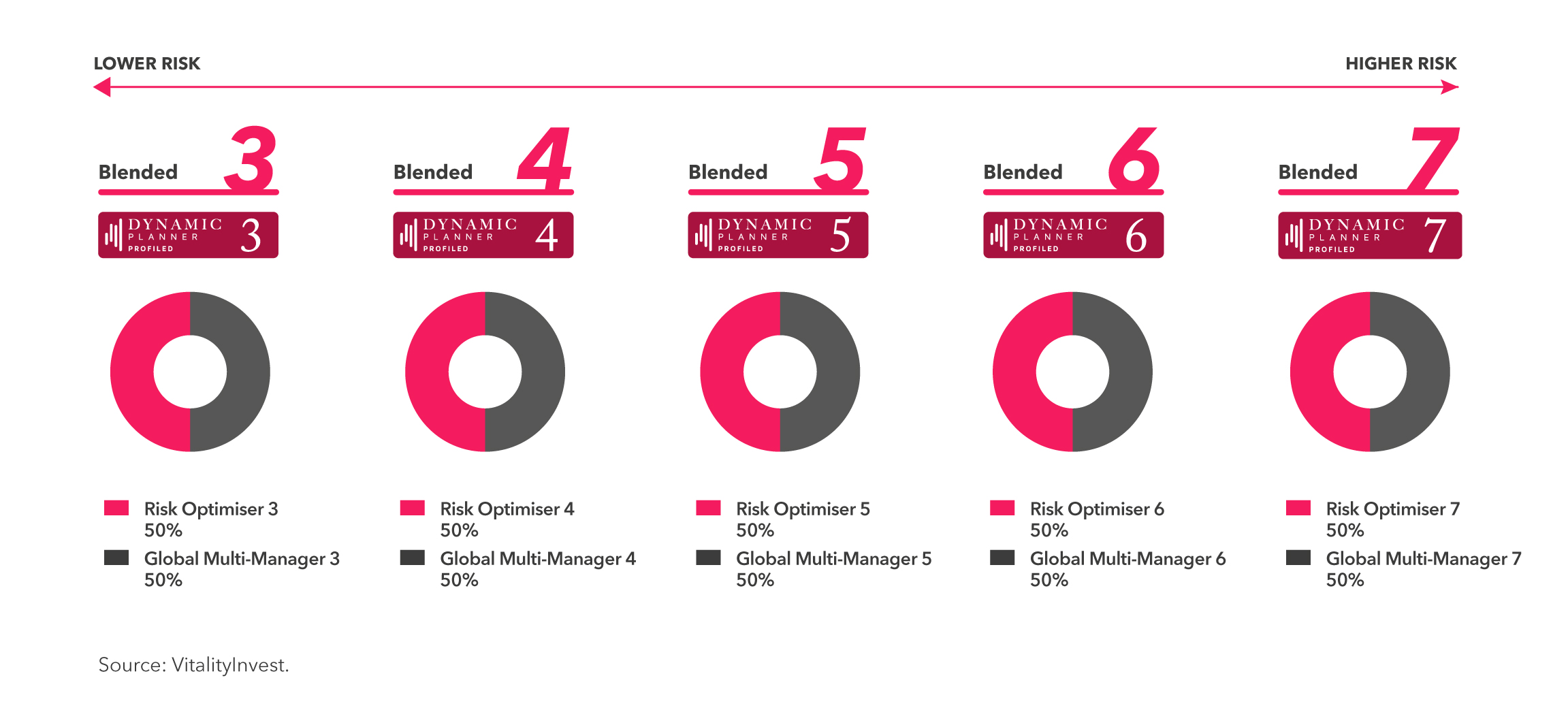

Expanding our fund range even further, with the VitalityInvest Blended fund range

We’ve also introduced a range of five ready-made, risk-profiled funds that blend actively managed and index-tracking strategies. Each fund is managed to maintain an equal weighting between the VitalityInvest Risk Optimiser, our multi-asset funds made up of index tracking strategies, and the VitalityInvest Global Multi-Manager funds that correspond to the specified risk profile.The funds aim to achieve long-term growth, while remaining broadly within their risk rating. Dynamic Planner independently reviews the asset allocation.

SEI – an experienced team with global reach

SEI is an award-winning asset manager with unparalleled expertise in investment manager selection, asset allocation and risk management. SEI’s global teams have decades of experience and use cutting-edge technology and research, which are leveraged in the design of our portfolio

Source: SEI, figures correct as of 30 September 2019

Calculated by SEI on 30 September 2019 with an exchange rate of 1 USD to 0.81329 GBP

*Lines open Monday to Friday, 9am - 5pm.

VitalityInvest is a trading name of Vitality Corporate Services Limited. Vitality Corporate Services Limited is authorised and regulated by the Financial Conduct Authority. 24/02/20 | This article’s view is based on the law, practices and conditions as at the day of publication. While we have made every effort to ensure they are accurate, we accept no responsibility for our interpretation or any future changes. | VI W 0218