What is a trust?

A trust is an arrangement which allows your client to gift an asset, such as a life assurance plan, without giving the intended recipient total control and legal ownership of it.

With a trust, your client who is known as the settlor, can transfer the legal ownership of an asset to someone. This person is the trustee. Trustees will look after the asset and can use it only for the benefit of people your client wants to benefit. The people who actually benefit from the asset held by the trustees are called "the beneficiaries".

All about trusts:

What are the benefits of putting something into trust?

Writing a policy into trust is a tax-efficient and sensible way to protect your clients’ policies and makes sure it ends up in safe hands.

What policies can be put into trust?

A VitalityLife policy can be put into trust whenever it suits you – at application or at a later date. Existing policies and PruProtect policies can also be put into trust.

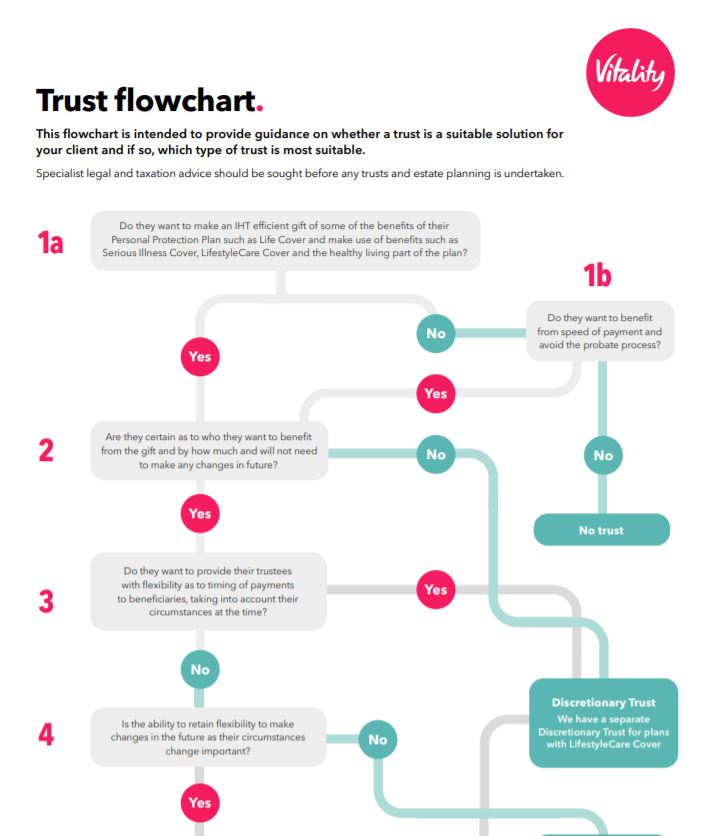

Have you used our Trust Flowchart?

Try out the Trust FlowchartWhat are the benefits of trusts?

Setting up a trust can be easier than you think and can provide your clients with real financial and protection benefits:

-

Tax planning

![one-symbol]()

Assets held in a valid trust won't be subject to Inheritance Tax (IHT) as part of your clients taxable estate on death. Instead, it will be subject to its own regime. If the assets aren't in a valid trust, up to 40% could be lost to the taxman on any part of an estate valued over £325,000.

-

Flexibility of gifts to future generations

![two-symbol]()

When an asset is held in trust, your clients may be able to influence the way the assets are distributed, along with which beneficiaries they are distributed to - either as acting as co-trustee or via a private side letter of wishes after death.

-

Protection

![three-symbol]()

Trusts can provide a layer of protection from third party claims. While funds are held in a discretionary trust, none of the potential beneficiaries has any right to them. The trustees can hold the funds back until a more suitable time for the intended beneficiaries to benefit.

Useful links to make trusts easier for you

Our literature libraries house our full suite of trust documents, along with a range of helpful guides and case studies.

-

Personal Protection Literature

Find out more about the different types of personal trusts we offer, along with supporting case studies and guides

-

Business Protection Literature

Explore our business protection trust literature to find out more about business protection trusts

Still unsure about trusts? Take a look at our Trust FAQs

Where to next?

-

Business Protection

Good health is good business. We aim to give your clients cover that's relevant to their business needs and pays out when they need it most.

-

Personal Protection

With our Personal Protection, we offer your clients the best cover to suit their needs, such as our award-winning Serious Illness Cover.

-

Literature Libraries

We have a range of literature available to make it easier for you to do business with us.

-

Online tools

Explore our wide range of online tools, designed to support your client conversations and help to grow your business.